Friday, September 9, 2011

Yield Curves -- Germany going to recession (or just bailout business?)

From Wall Street Transcript, via yahoo (my bolding):

Edward M. Dempsey: The German yield curve is beginning to invert. Yield curves should be positively sloped if all is well since it reflects healthy demand for money. When you get an inverted yield curve, it is a very reliable harbinger of a coming recession. It reflects concerns of an economic slowdown and deflationary period. So now you can have a scenario where if Germany enters recession, and given that Germany is the strongest link in the euro chain, what happens to Greece, Italy, Spain and Portugal? In that kind of a scenario, German public support for the euro can very, very quickly evaporate. Everyone is worried about Greece being kicked out of the euro, but what if you wake up and Germany says, "We are out of the euro"? I don't believe that is outside the realm of possibility.

Image from mish:

Interactive Chart from financial times:

Edward M. Dempsey: The German yield curve is beginning to invert. Yield curves should be positively sloped if all is well since it reflects healthy demand for money. When you get an inverted yield curve, it is a very reliable harbinger of a coming recession. It reflects concerns of an economic slowdown and deflationary period. So now you can have a scenario where if Germany enters recession, and given that Germany is the strongest link in the euro chain, what happens to Greece, Italy, Spain and Portugal? In that kind of a scenario, German public support for the euro can very, very quickly evaporate. Everyone is worried about Greece being kicked out of the euro, but what if you wake up and Germany says, "We are out of the euro"? I don't believe that is outside the realm of possibility.

Image from mish:

Interactive Chart from financial times:

Wednesday, September 7, 2011

Economist looks at Suez traffic vs. world GDP

Running aground

Sep 2nd 2011, 13:56 by The Economist online

An alternative indicator points to a slowing world economy

FURTHER economic strife may be ahead as a swathe of recently released data points to a slowdown in the world economy. This is confirmed by one alternative measure: the amount of cargo passing through the Suez Canal in Egypt. Approximately 8% of the world's international trade is estimated to flow through the canal, so it acts as a good early indicator of the prevailing economic conditions. The average increase in the total weight of cargo passing through the canal was 5.7% in the three months to July, down from 9.5% in December. Making a simple forecast based on the past few months' data suggests that world GDP will fall from 3.8% in the first quarter to 3.3% in the second quarter.

Labels:

Economist chart,

forecast,

recession

Zack's forecast

http://www.zackswmg.com/pdf/econreport.pdf

selections:

...

Accordingly, we have marked down our forecast of growth signifi cantly, and we now do not expect a return to abovetrend growth until the second half of 2012. That is, the U.S. effectively remains in a “growth recession” for at least another half year while the unemployment rate drifts higher. Even with the boost to growth expected from the reversal of temporary factors that restrained growth over the fi rst half of this year—adverse weather, spiking energy prices, and supply-chain disruptions stemming from the earthquake in Japan—growth over the second half of this year is expected to average only about 2¼%, down from 3.4% in last month’s forecast. Growth is expected to fi rm in 2012, but to a modest 2.8%. This forecast assumes that the persistent forces restraining growth, i.e., the variable headwinds, dissipate sufficiently by 2013 that growth can reach 4% that year.

...

We now expect the U.S. economy will, at best, muddle through until the problems restraining growth get resolved. This implies growth barely at trend through the fi rst half of 2012, i.e. a continuation of the growth recession that began last year. Growth is expected to pick up in the second half of next year to average roughly 3%, but growth for the year as a whole remains only modestly above trend in 2012 at 2.8%. As a result, the unemployment rate is expected to decline only gradually from a peak of 9.3% later this year to 8.7% in the fourth quarter of next year.

...

we expect financial conditions to improve gradually, albeit starting from levels that are not as supportive of aggregate demand as we previously expected. Growth over 2012 is expected to be roughly 2.8%, about ½ percentage point better than over the second half of this year, but nearly ¾ of a percentage point weaker

than we had expected in last month’s forecast. In 2013, we expect GDP growth to accelerate, to 4.1%, as business fixed investment and housing contribute more significantly to the expansion, and as further improvements in labor market conditions and household balance sheets support a modest further acceleration in consumer spending.

...

Firms remain flush with cash and borrowing costs remain near historic lows. Investment in nonresidential structures, which has been particularly hard hit, appears to be turning up and so will swing from being a drag on GDP growth to being a modest contributor. More important to the big picture is the continued strength in equipment and software investment. Business spending on computers and software rose 21.4% at an annual rate in the second quarter, and is expected to continue to rise at low double-digit rates over the next couple of years.

...

recent developments suggest that the European sovereign debt crisis will keep uncertainty high for some time and that this will depress the prices of risky assets relative to our recent forecasts. This is evident in the wider risk spreads and weaker stock prices in this forecast relative to prior projections. Indeed, if the US economy does end up slipping into recession, the most obvious and likely cause is a significant meltdown in Europe.

selections:

...

Accordingly, we have marked down our forecast of growth signifi cantly, and we now do not expect a return to abovetrend growth until the second half of 2012. That is, the U.S. effectively remains in a “growth recession” for at least another half year while the unemployment rate drifts higher. Even with the boost to growth expected from the reversal of temporary factors that restrained growth over the fi rst half of this year—adverse weather, spiking energy prices, and supply-chain disruptions stemming from the earthquake in Japan—growth over the second half of this year is expected to average only about 2¼%, down from 3.4% in last month’s forecast. Growth is expected to fi rm in 2012, but to a modest 2.8%. This forecast assumes that the persistent forces restraining growth, i.e., the variable headwinds, dissipate sufficiently by 2013 that growth can reach 4% that year.

...

We now expect the U.S. economy will, at best, muddle through until the problems restraining growth get resolved. This implies growth barely at trend through the fi rst half of 2012, i.e. a continuation of the growth recession that began last year. Growth is expected to pick up in the second half of next year to average roughly 3%, but growth for the year as a whole remains only modestly above trend in 2012 at 2.8%. As a result, the unemployment rate is expected to decline only gradually from a peak of 9.3% later this year to 8.7% in the fourth quarter of next year.

...

we expect financial conditions to improve gradually, albeit starting from levels that are not as supportive of aggregate demand as we previously expected. Growth over 2012 is expected to be roughly 2.8%, about ½ percentage point better than over the second half of this year, but nearly ¾ of a percentage point weaker

than we had expected in last month’s forecast. In 2013, we expect GDP growth to accelerate, to 4.1%, as business fixed investment and housing contribute more significantly to the expansion, and as further improvements in labor market conditions and household balance sheets support a modest further acceleration in consumer spending.

...

Firms remain flush with cash and borrowing costs remain near historic lows. Investment in nonresidential structures, which has been particularly hard hit, appears to be turning up and so will swing from being a drag on GDP growth to being a modest contributor. More important to the big picture is the continued strength in equipment and software investment. Business spending on computers and software rose 21.4% at an annual rate in the second quarter, and is expected to continue to rise at low double-digit rates over the next couple of years.

...

recent developments suggest that the European sovereign debt crisis will keep uncertainty high for some time and that this will depress the prices of risky assets relative to our recent forecasts. This is evident in the wider risk spreads and weaker stock prices in this forecast relative to prior projections. Indeed, if the US economy does end up slipping into recession, the most obvious and likely cause is a significant meltdown in Europe.

Labels:

forecast

Tuesday, September 6, 2011

Europe -- The Final Countdown

20 Quotes From European Leaders That Prove That They Know That The Financial System In Europe Is Doomed

Mish has a good post about the good times in Europe right now

Not only that, but it's messing up the U.S. markets: From zerohedge:

check out this for euro/us gold play

Friday, September 2, 2011

European Banking crisis

another Ambrose Evans-Pritchard gem:

Central bank flight to Federal Reserve safety tops Lehman crisis

A key warning signal of global financial stress has shot above the extreme levels seen at the height of the Lehman crisis in 2008.

Cutout:

Data from the St Louis Fed shows that reserve funds from "official foreign accounts" have doubled since the start of the year, with a dramatic surge since the end of July when the eurozone debt crisis spread to Italy and Spain.

"This shows a pervasive loss of confidence in the European banking system," said Simon Ward from Henderson Global Investors. "Central banks are worried about the security of their deposits so they are placing the money with the Fed."

Labels:

banks,

charts,

Europe,

eurozone,

financial crisis

Europe Grinds to a Halt?

Europe Grinds To A Halt

Eurozone PMI plunged to a two-year low this morning, indicating a worse-than-expected slowdown and triggering declines for the euro on easing expectations.

Manufacturing PMI -- regarded as an early indicator of recession -- fell to 49.0 in August from 50.4 in July, indicating that while GDP is still expanding manufacturing is stalled.

According to Credit Suisse, inventories are at their highest since December 2008, but the lack of demand for goods means that manufacturers will probably have to cut production to reduce overhead in the months ahead. If we regard this orders-to-inventories statistic as an early indicator for manufacturing PMI and ISM, then we're likely to see these numbers slip further over the next few months

Thursday, September 1, 2011

QE2 vs QE3?

Great zerohedge article about the difference between QE2 and the inevitable (?) QE3. Read it!

Slowdown? / Focus is on Europe!

ITALY: Bank of Italy warns on growth as bond sale falters -- Reuters

EURO BANKS 1: WSJ article (need login, but even if you don't the key point is above the login): In a 54-page report sent to hundreds of Goldman's institutional clients dated Aug. 16, Alan Brazil—a Goldman strategist who sits on the firm's trading desk—argued that as much as $1 trillion in capital may be needed to shore up European banks; that small businesses in the U.S., a past driver of job production, are still languishing; and that China's growth may not be sustainable.EURO BANKS 2: Business Insider article: The Latest on the funding situation at European Banks:

"Regardless of the actual liabilities of these banks, it is doubtful any of them could have planned for this sudden drop in equity. At the same time, earnings aren't picking up the slack. Add that to new fears that the Greek bailout will not go through quickly enough to save Greece from a full-blown default (no selectivity) and the ensuing contagion risks.

The real wild card here is the European Central Bank. It could provide virtually unlimited funds to these banks, but their balance sheets have to be strong enough to qualify for lending. This should not be a problem in France and Germany, but the longer it takes to come out with a viable solution to this crisis, the more likely this problem could be."LIBOR RISE: Finally, a nice Chart from Business Insider about LIBOR rates

Major banks on both sides of the Atlantic are self-reporting higher and higher interbank USD borrowing rates, meaning that funding is getting more expensive in a hurry.

This graph from ZeroHedge demonstrates a sharp rise in the 3-month USD LIBOR -- a benchmark interest rate for short-term borrowing of U.S. dollars -- over the last two months. Every bank detailed saw an increase in its short-term borrowing costs.

Reuters reports that European banks are paying slightly more than the fixed LIBOR rate while U.S. banks slightly less. On the whole, 3-month rates are at their highest since last August.

We keep talking about signs that the funding situation for eurozone banks is going downhill, and this looks like the newest sign that dollars are becoming increasingly expensive. Rising borrowing costs could provoke a credit crunch that would lead to another global slowdown.

Labels:

banks,

charts,

eurozone,

financial crisis,

forecast

Monday, August 29, 2011

US forecast, China Slowdown, gold/bonds compared to 2008, and Germany / EU debt

All eyes on Germany in September. Things are not looking good for Merkel or the German Economy. Here are a bunch of different mini-posts that all point to the same outcome -> this Fall will be "interesting" for lack of a better term, and the next 3 years can be painful.

News from around the world:

News from around the world:

GDP adjusted for CPI

nothing big from Bernanke. Might have to do something sooner rather than later:

From Moneygame: The economy grew by 1% in the second quarter, according to inflation-adjusted preliminary data released by the Bureau of Economic Analysis.

But to most Americans it did not feel like growth.

That's because the inflation adjustment used by the BEA is far more conservative than the Bureau of Labor's consumer price index, which is based on prices paid for goods and services -- i.e. the things that consumers notice.

Thursday, August 25, 2011

Anticipating Bernanke

what will he say?

QE3 is a doubtful forecast. check this Many are thinking the Fed might not go there again.

Other options:

Buying longer end Treasuries -- lower real rates -- bad for dollar, good for gold & possibly stocks

Reduce bank reserve's interest to zero -- force loans/credit

Cap yields on treasuries (short and medium term) -- spur spending / lending

QE3 is a doubtful forecast. check this Many are thinking the Fed might not go there again.

Other options:

Buying longer end Treasuries -- lower real rates -- bad for dollar, good for gold & possibly stocks

Reduce bank reserve's interest to zero -- force loans/credit

Cap yields on treasuries (short and medium term) -- spur spending / lending

Labels:

forecast,

interest rates

Wednesday, August 24, 2011

Herd mentality?

gold correcting [profit taking, too high?, potential increased margin requirement coming, markets stabilizing? (I think not), testing support?]

Check out this one from money game: Herd mentality has descended upon Wall Street, as S&P 500 stock correlation reaches its highest levels ever. This unseats former records set in 1987, when portfolio insurance strategies caused stocks to tumble in tandem. Analysts have learned to expect high correlation in bear markets, when investors rush to sell off equities. But Felix Salmon has noted that the rise of high-frequency trading and ETFs could mean that high correlation is just part of a larger trend. Either way, this spike in correlation is far from reassuring for markets.

I think that people are driving the market up for one last shot at profit taking. We fell pretty hard, but there's no justification for a rally or run-up. Who knows?

Tuesday, August 23, 2011

shift to Europe

follow the Eurozone: http://macrosnap.blogspot.com/2011/07/interactive-eurozone-chart.html

Also from the Economist: Dylan Grice at Societe Generale is one of the top rated strategists in London who has long argued for an overweight cash and long gold position. He thinks the markets are pushing the central banks to monetise the issue; with the Fed indulging in a third round of QE and the ECB loosening the purse strings to buy unlimited bonds. However, he thinks it may take more of an air of crisis before the authorities finally capitulate; perhaps a big European bank in trouble or if French yields start widening towards Spanish levels.

Also from the Economist: Dylan Grice at Societe Generale is one of the top rated strategists in London who has long argued for an overweight cash and long gold position. He thinks the markets are pushing the central banks to monetise the issue; with the Fed indulging in a third round of QE and the ECB loosening the purse strings to buy unlimited bonds. However, he thinks it may take more of an air of crisis before the authorities finally capitulate; perhaps a big European bank in trouble or if French yields start widening towards Spanish levels.

Friday, August 19, 2011

Armstrong 8/19 support levels

Gold:

We closed above 1818 today, warning we can still press higher into tomorrow

This week’s resistance at 1860-1900, then 2050-60; close above 1900 signals explosive run next week.

Next week: 1910-1960, then 2085-2105.

If 2100 broken, possible phase transition to 2400-2600 level this month.

Support forming at 1730; we stay bullish if this holds on closing basis.

We closed above 1818 today, warning we can still press higher into tomorrow

This week’s resistance at 1860-1900, then 2050-60; close above 1900 signals explosive run next week.

Next week: 1910-1960, then 2085-2105.

If 2100 broken, possible phase transition to 2400-2600 level this month.

Support forming at 1730; we stay bullish if this holds on closing basis.

DJIA:

Close below 11280 signals weakness.

Close below 10906 may signal sharp drop next week.

Monthly close below 10320 points to retest of 2009 low with support at 6952

Close below 11280 signals weakness.

Close below 10906 may signal sharp drop next week.

Monthly close below 10320 points to retest of 2009 low with support at 6952

http://www.jsmineset.com/2011/08/10/in-the-news-today-944/

Indicators -- point to recession?

Philadelphia Fed Business Outlook Survey results: (the only positive thing about this is that it's regional & was taken during the height of the debt ceiling debate)

The survey’s broad indicators for activity, shipments, and new orders all declined sharply from last month. Firms indicated that employment and average work hours are lower this month. Price indexes continued to show a trend of moderating price pressures. The broadest indicator of future activity also weakened markedly, but firms still expect overall growth in shipments, new orders, and employment over the next six months. The collection period for this month’s survey ran from August 8-16, overlapping a week of unusually high volatility in both domestic and international financial markets.

All Indicators Show Declines

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a slightly positive reading of 3.2 in July to -30.7 in August. The index is now at its lowest level since March 2009

________________________8/1 Institute of Supply Management report about July:

Production and Employment Growing

Supplier Deliveries Slower

New Orders and Inventories Contracting

(Tempe, Arizona) — Economic activity in the manufacturing sector expanded in July for the 24th consecutive month, and the overall economy grew for the 26th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

Thursday, August 18, 2011

EOCI Index NOW at recession levels

European Banks -- BIG TROUBLE AHEAD for everyone

from zerohedge:

Cue Panic As Fed Resumes Liquidity Swap Lines, Lends $200 Million To Swiss National Bank, Most Since October 2010

Submitted by Tyler Durden on 08/18/2011 - 16:19If yesterday's news broken by ZH that one bank was in dire need of US dollars and ended up borrowing $500 million from the ECB was enough to send the market down almost 5% today, then the follow up news that the FRBNY just reactivated FX swap lines with Europe will likely send ES limit down at tomorrow's open. The FRBNY has just announced that in the week ended August 17, it lent out $200 million to not the ECB, not the BOE, but the "most stable" of all banks: the SNB. This is the first use of the Fed's Swap Lines since March, and the most transacted under this "last ditch global bailout swap line" (see more on how the Fed bailed out the world using swap lines here) since October 2010. This event also gives us a hint that the European bank in question in dire need of cash is Swiss, which in turn means that it is not some usual PIIGS suspect, but one of the two "big ones." If true, this means that the European insolvency, liquidity and what have you crisis is about to take an exponential step function higher.

Labels:

banks,

eurozone,

financial crisis

Tuesday, August 16, 2011

Soros interview -- Germany & Eurobonds?

Der Spiegel Interview with George Soros

'You Need This Dirty Word, Euro Bonds'

In a SPIEGEL interview, billionaire investor George Soros criticizes Germany's lack of leadership in the euro zone, arguing that Berlin must dictate to Europe the solution to the currency crisis. He also argues in favor of the creation of euro bonds as a way out of the turbulence.Monday, August 15, 2011

August U of M Consumer Sentiment Index

moneygame chart of the day:

As the chart shows, the reading has now hit a level not seen since early 2008.

As the chart shows, the reading has now hit a level not seen since early 2008.

The latest University of Michigan sentiment numbers (which came in very weak) underscore an emerging trend in the economy right now: There's a pretty big gap between sentiment and "the data." Sentiment, expressed by surveys (consumer surveys, NFIB small business, and yes, even the stock market, which is a daily survey) have been pretty ugly lately. The data actually hasn't been that bad. Job numbers have actually been solid, with initial claims coming in below 400K this week. The retail sales number that came out this morning was surprisingly strong. Earnings for the quarter: Pretty excellent. One of the two will have to give. Either the market will rebound, and people will see that the freakout was unfounded (That's basically the case made by Matt Busigin here) or the data will catch up to the downside, which would be bad.

Read more: http://www.businessinsider.com/economy-wile-e-coyote-moment-2011-8#ixzz1V6NYKCnh

More fun charts:

Read more: http://www.businessinsider.com/economy-wile-e-coyote-moment-2011-8#ixzz1V6NYKCnh

More fun charts:

Friday, August 12, 2011

Dow Historical Corrections / VIX

from chartoftheday.com:

VIX at highest since 2008:

For some perspective on the current correction, today's chart illustrates all major stock market corrections (15% loss or greater) of the last 111 years. Each dot represents a major correction as measured by the Dow. For example, the bear market that began in 1973 lasted 481 trading days and ended after the Dow declined 45%. There are a few items of interest... Since 1900, the Dow has undergone a major correction 26 times or one major correction every 4.3 years. Second, most major corrections since 1900 (62%) have resulted in a drop of less than 40% while lasting less than 400 trading days. Since 1950, the percentage of major market corrections that were less than 40% and 400 trading days increased to 78%. As it stands right now, the current stock market correction (April 2011 peak to most recent low) would measure below average in both magnitude and duration.

VIX at highest since 2008:

Labels:

market

Thursday, August 11, 2011

French CDs, US market

French president Nicolas Sarkozy gave his finance and budget ministers a week to devise new measures to cut France’s budget deficit as shares in the country’s banks plummeted in the latest bout of financial markets turmoil http://ftalphaville.ft.com/thecut/2011/08/11/650251/focus-of-eurozone-crisis-turns-to-france/

Meanwhile, French CDs hit what Italy's were at in July:

Trading in equities and derivatives has hit record levels this week, the FT reports, as investors traded frantically in response to a tumult of factors such as the US Federal Reserve’s decision to stick with near-zero interest rates until 2013, http://ftalphaville.ft.com/thecut/2011/08/11/650191/trading-volumes-reach-record-levels/

Even after the recent plunge, stocks are still about 20% overvalued when measured on Professor Robert Shiller's "normalized" earnings--earnings adjusted to normalize profit margins--which is one of the only valuation measures that works. Specifically, even after the crash, stocks are still trading at 19X cyclically adjusted earnings. As we can see in the following chart from Professor Shiller, over the past century, stocks have averaged about 16X those earnings. So we're still about 20% above "normal." Importantly, though, 19X is a lot closer to normal than the ~24X recent peak. Stocks certainly aren't "cheap," but they're also not wildly overvalued anymore. (Source)

Bill Gross was right after all, though that hasn’t helped his investors this year. Former White House economic adviser Lawrence Summers and Christina Romer, the former chairman of the U.S. Council of Economic Advisers, were among critics who challenged a view promoted by Gross’s Pacific Investment Management Co. that the U.S. economy may be headed for a long period of below-average growth and high unemployment, a scenario known as “new normal.” Money manager Kenneth Fisher called the concept “idiotic.” http://www.bloomberg.com/news/2011-08-10/pimco-s-gross-proves-summers-wrong-as-selloff-shows-new-normal-is-real.html

Bill Gross was right after all, though that hasn’t helped his investors this year. Former White House economic adviser Lawrence Summers and Christina Romer, the former chairman of the U.S. Council of Economic Advisers, were among critics who challenged a view promoted by Gross’s Pacific Investment Management Co. that the U.S. economy may be headed for a long period of below-average growth and high unemployment, a scenario known as “new normal.” Money manager Kenneth Fisher called the concept “idiotic.” http://www.bloomberg.com/news/2011-08-10/pimco-s-gross-proves-summers-wrong-as-selloff-shows-new-normal-is-real.html

sources -- zerohedge News you need to know (it's true) & moneygame chart of the day

Tuesday, August 9, 2011

Market and economic overview

From Zacks (Steve Reitmeister)

A little bit longer one from David Rosenberg, Chief Economist & Strategist, Gluskin Sheff. (I HIGHLY RECOMMEND READING THIS!) Courtesy of Mauldin's free email letter. Instead of pullouts, I've bolded key points:

The tumbling of the market on Monday would have happened sooner or later given a deteriorating economic picture. So the S&P proclamation just sped up the process. But now we are at an interesting juncture. The major indices are all down around 16% from their peaks. That is a hefty discount when there is no proof yet of a recession and Corporate America just had a great earnings season. It could be said that risk and reward are now evenly matched and the next step for the market should be based upon the fundamental outlook.

Meaning that if the economy is not headed into a recession, then stocks are a bargain and should head higher from here. Unfortunately the flip side is true as well. So if we do slip into a recession, then stocks will probably lose another 20-30% from these levels. Because of where we stand now, I am no longer so short the market. You could say that I have a created something akin to an options straddle with the use of leveraged ETFs. This will allow me to make money when the market decides to break out in one direction or the other. Until that happens I will be around breakeven for a while (I can think of worse outcomes ;-)

A little bit longer one from David Rosenberg, Chief Economist & Strategist, Gluskin Sheff. (I HIGHLY RECOMMEND READING THIS!) Courtesy of Mauldin's free email letter. Instead of pullouts, I've bolded key points:

As we had suggested in recent weeks, a U.S. downgrade was going to likely be more negative for the equity market than Treasuries, and that is exactly how the week is starting off. The reason is that history shows that downgrades light a fire under policymakers and the belt-tightening budget cuts ensue, taking a big chunk out of demand growth and hence profits. It is not just the United States — the problem of excessive debt is global, from China to Brazil to many parts of Europe. And let’s not forget the Canadian consumer. |

Monday, August 8, 2011

John Mauldin / New Armstrong essay

http://www.johnmauldin.com/frontlinethoughts/the-case-for-going-global-is-stronger-than-ever/

I picked a nice time to take some time off!!! I'll have things to say as the week progresses, but Mauldin had a great guest post on Friday about emerging markets. Good text & charts. Worth a read.

Also, new-ish Armstrong essay (8/4/11). 3 pager def. worth a read

I picked a nice time to take some time off!!! I'll have things to say as the week progresses, but Mauldin had a great guest post on Friday about emerging markets. Good text & charts. Worth a read.

Also, new-ish Armstrong essay (8/4/11). 3 pager def. worth a read

Labels:

Armstrong,

Emerging Economies,

Mauldin

Wednesday, August 3, 2011

Tuesday, August 2, 2011

Schwab/Yahoo report -- Economy stalling

Schwab link (lots of nice charts, too)

Key pointsBuilding on the last bullet point, Yahoo report link:

- Although the debt deal remains top-of-mind, the latest GDP report's weakness didn't ease the angst.

- The economy is now operating at "stall speed" and is at a crucial inflection point.

- There's no much good news other than corporate profits, which have boomed.

I didn't believe it myself until I was joined by John Butters, the Senior Earnings Analyst from FactSet. With roughly 2/3 of the S&P500 having reported Butters has cut into the data. Frankly if you saw the figures in a vacuum you'd have to be impressed:

* 78% of companies reporting have beaten expectations EPS estimates8/9/11: And now, of course, we have to really check this out. Post from 8/09/11 sheds some light on this

* 73% of have beaten revenue estimates

* Earnings and revenue have been growing at roughly the same rate

* 45 companies have lowered estimates while 25 have raised guidance

Monday, August 1, 2011

Recession & 2011 Q1 worse than reported

from Consumer Metrics Institute. Great (scary) charts. scroll down for full article. First paragraph:

Included in the BEA's first ("Advance") estimate of second quarter 2011 GDP were significant downward revisions to previously published data, some of it dating back to 2003. Astonishingly, the BEA even substantially cut their annualized GDP growth rate for the quarter that they "finalized" just 35 days ago -- from an already disappointing 1.92% to only 0.36%, lopping over 81% off of the month-old published growth rate before the ink had completely dried on the "final" in their headline number. And as bad as the reduced 0.36% total annualized GDP growth was, the "Real Final Sales of Domestic Product" for the first quarter of 2011 was even lower, at a microscopic 0.04%.

Labels:

recession

Friday, July 29, 2011

Germany's place in Eurozone

from STRATFOR. Key pullout:

Germany is achieving by stealth what it failed to achieve in the past thousand years of intra-European struggles. In essence, European states are borrowing money (mostly from Germany) in order to purchase imported goods (mostly from Germany) because their own workers cannot compete on price (mostly because of Germany)There's also a great article describing the current Eurozone crisis & Germany's choices.

Even though they're from 2010, both articles are awesome -- great background and analysis of issues that aren't going away

Labels:

charts,

eurozone,

financial crisis,

Germany

Thursday, July 28, 2011

My last post on the Debt Ceiling

actually, it's not mine, it's Surowiecki's, and as usual, it's a great, short article that lays it all out

"...if Congress really wants to hold down government debt, it already has a way to do so that doesn’t risk economic chaos—namely, the annual budgeting process. The only reason we need to lift the debt ceiling, after all, is to pay for spending that Congress has already authorized. If the debt ceiling isn’t raised, we’ll face an absurd scenario in which Congress will have ordered the President to execute two laws that are flatly at odds with each other. If he obeys the debt ceiling, he cannot spend the money that Congress has told him to spend, which is why most government functions will be shut down. Yet if he spends the money as Congress has authorized him to he’ll end up violating the debt ceiling..."

STUPID

"...if Congress really wants to hold down government debt, it already has a way to do so that doesn’t risk economic chaos—namely, the annual budgeting process. The only reason we need to lift the debt ceiling, after all, is to pay for spending that Congress has already authorized. If the debt ceiling isn’t raised, we’ll face an absurd scenario in which Congress will have ordered the President to execute two laws that are flatly at odds with each other. If he obeys the debt ceiling, he cannot spend the money that Congress has told him to spend, which is why most government functions will be shut down. Yet if he spends the money as Congress has authorized him to he’ll end up violating the debt ceiling..."

STUPID

Labels:

new yorker,

u.s. debt

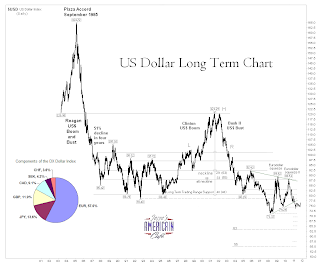

Gold & Dollar

Long Term trend in Gold from Trader Dan from '09 to '11 along with the performance of the dollar the last 8 months. Jesse's Cafe is still my go-to place for gold, silver, and dollar charts.

UK GDP

"The economy has effectively flat-lined for nine months and this is very bad news for jobs, living standards, business investment and for getting the deficit down."

"Last June, the OBR [Office for Budget Responsibility] predicted GDP would grow by 2.6% in 2011, but even if the economy gets back on track in quarters three and four this year, it will barely reach 1.2%," said IPPR director Nick Pearce.

Wednesday, July 27, 2011

Home Prices & Inventories

Love businessinsider.com & their "Chart of the Day" services. Here's a couple from the MoneyGame section. You can subscribe for email blasts.

This chart plots the year-over-year change in the 20-city composite, and as you can see, the decline accelerated again, hitting the fastest pace since 2009.

(source -- moneygame chart of the day)

This chart plots the year-over-year change in the 20-city composite, and as you can see, the decline accelerated again, hitting the fastest pace since 2009.

(source -- moneygame chart of the day)

Last week, the NAR reported disappointing existing homes sales. Here's what makes the number particularly ominous: Housing supply is continuing its sharp "v" pattern, as it shoots towards 10 months. As long as this is going up, expect more headaches, lower prices, and overall housing market misery. (via Calculated Risk)

(source -- moneygame chart of the day)

Labels:

Case-Shiller,

charts,

housing

Tuesday, July 26, 2011

Who Holds the Federal Debt

Great interactive chart here. You should def. go check it out. I'll be moving away from the debt stuff this week to actual stuff. Just back from D.C., so haven't posted in a while

Labels:

interactive chart,

u.s. debt

Thursday, July 21, 2011

Greece Bailout

Very good Bloomberg article explaining what went down & ideas about impact/future Eurozone fun (pullouts after the jump). Graphic from France 24 (along with another good article)

Wednesday, July 20, 2011

Germany to the rescue again? Telegraph UK editorial & BBC Article

Only Germany can save EMU as contagion turns systemic

Europe's leaders have finally run out of time. If they fail to agree on some form of debt pooling and shared fiscal destiny at Thursday's emergency summit, they risk a full-fledged run on South Europe's bond markets and a disorderly collapse of monetary union.Although it seems like Germany has no interest in taking on more responsibility (BBC article)

(i.e. creating Eurobonds, bailouts, whatever) & maybe if Merkel's hands are tied then the Euro experiment is reaching an unfortunate conclusion?

check it:

UK hit by Eurozone Crisis

UK banks dragged into eurozone crisis as global markets take fright

Lloyds, RBS and Barclays take £5bn hit as stock and commodity prices plummet, while US urges Europe to be more decisive

Interesting b/c two days ago, zerohedge posted the Sigma X screen showing major action on Lloyds indicating a shift from Eurozone wackiness from Italy to UK. Sigma X is the Goldman dark pool trading center. Dark pools are trading centers where buyers/sellers are anonymously paired up & action happens outside the trading markets. More info on this zerohedge post.

Subscribe to:

Posts (Atom)